Payments on account are advanced payments towards your tax bill. If you’re submitting a self assessment tax return, you’re required to pay some of your estimated tax liability in advance before the end of the next financial year. As a result, you must make two payments on account every year to help prevent you from becoming indebted to HM Revenue and Customs (HMRC).

To help you understand how the process works, we’ve put together the following guide.

How is payment on account calculated?

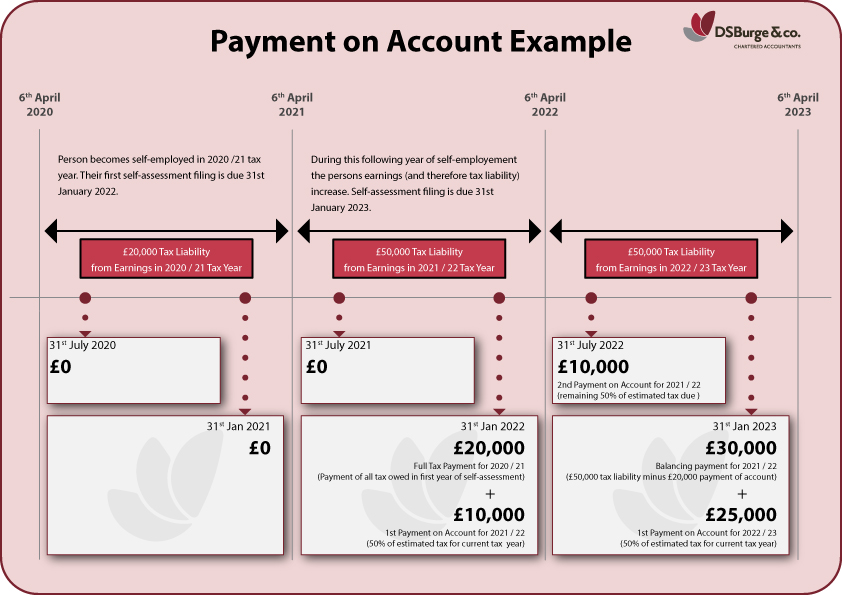

Each payment on account is typically half your previous year’s tax bill. The first instalment is due on 31 January. The second instalment is due on 31 July, typically 50% of your previous year’s tax bill. This amount can change if you need to make a ‘balancing payment’. You’ll have to make a balancing payment if your tax liability increases and the amount you’ve already paid on account no longer covers half of this. We’ve got an example below to explain how this works.

There are also exemptions to payments on account. For example, if your last Self Assessment tax bill was less than £1,000, then you don’t have to make two payments on account every year. The same rule applies if you’ve already paid more than 80% of all the tax you owe at source (eg. through your payslips if you earn a salary).

Payment on account example

Why is my first payment on account high?

In your first year, you’re required to pay 150% of your tax bill. As the example above illustrates, this allows you to pay the total tax liability for your previous tax year and your first payment on account for the current tax year.

When can you reduce payments on account?

There are a few situations in which you can reduce your payments on account. For example, if your earnings for the current tax year are going to be lower than the previous tax year. This is fairly common for self-employed individuals, as income can fluctuate from year to year. If you suspect that your income will be lower than the previous tax year, you can let HMRC know by:

- Logging into your HMRC online account and select “Reduce Payments on Account.”

- Downloading, printing, and sending an SA303 form to your tax office.

Please be aware that if you end up underpaying HMRC, they will charge interest. On the other hand, if you end up overpaying HMRC, they’ll issue you a tax refund. If this happens, just use form SA303 to reduce your payments on account and request a refund, or get in touch with our team of expert accountants, and we can help manage the whole process for you.

How to pay your payment on account

To pay your payment on account, you’ll need your10-digit Unique Taxpayer Reference (UTR) followed by the letter ‘K.’

Faster ways to pay

Below are the fastest ways (same or next day) you can pay your payment on account:

- Through your online bank account: Select the ‘pay by bank account’ option on the HMRC website and sign in to your online or mobile banking account.

- Debit or credit card online: To avoid a fee, you can pay by personal debit card. But if you pay by corporate credit card or corporate debit card, you must pay a fee. In addition, you can’t use a personal credit card to pay your payment on account.

- At your bank: You can use this option if you get paper statements from HMRC or a paying-in slip from HMRC.

Slower payment methods

If you don’t mind the extra time it takes for funds to post, you can use these methods (3-5 working days)

- Direct Debit: Set up single payments through your HMRC online account.

- By cheque through the post: Include your payslip from HMRC, or you can print a slip to pay by post.

If you’re using one of the slower methods to pay your payment on account, make sure you send your payment in advance so that it reaches HMRC before your deadline. This is especially important if the deadline falls on a weekend or bank holiday.

Pay through your tax code

You can also pay your payment on account through your PAYE tax code. But you must meet the following criteria:

- You owe less than £3,000 on your tax bill

- You already pay tax through PAYE

- You submitted your paper tax return by 31 October or your online tax return online by 30 December

If this represents your situation, then HMRC will automatically collect what you owe through your tax code. They will take out the tax you owe from your salary in equal instalments over 12 months, along with your usual tax deductions. You won’t be able to pay through your tax code if you don’t have enough PAYE income for HMRC to collect it, pay more than 50% of your PAYE income in tax, or end up paying more than twice as much tax as you normally do.

What if you can’t pay your payment on account by the deadline?

If you can’t afford to pay your payment on account in full by the due date, you may have options. In certain situations, you can set up a payment plan. However, you must:

- Have no other payment plans or debts with HMRC

- Have up-to-date tax returns

- Owe no more than £30,000

- Apply less than 60 days after the deadline

This can help you split your bill into more manageable payments. The catch is, you’ll have to pay interest. Furthermore, if you don’t stay on top of your payments, HMRC can ask you to pay your bill in full.

At DS Burge & Co, we always recommend seeking the help of our accountants with your self-assessment tax returns service. We can help calculate your liability and manage the whole process on your behalf.