Invoicing is an essential part of running a limited company. You will need to issue an invoice to a client whenever you need to take payment following the purchase of either a service or product from your company. As the owner of a limited company, you are required by law to include several details on your invoice.

Outlining the services or products that were purchased clearly and in detail can help you easily keep a record of the transaction and help the customer understand what they are being charged for. This can help to minimise the need for clarification and ensure you are paid promptly.

The invoicing process is fast and straightforward once you have a good template. This article outlines the details you’re legally required to include on the document and some tips to help you complete the invoicing process.

Table of Contents

What Information Are You Legally Required to Include on a Limited Company Invoice?

It is a legal requirement to include the following information on your limited company invoice:

- A unique identification number

- Your full company name as it appears on the certificate of incorporation, company address, and contact information

- The company name and company address of the customer you’re invoicing

- Clear information about the product and/or service(s) you’re charging for

The date the goods or service were provided to the customer - The date the invoice is being sent

- The amount(s) being charged

- VAT amount (if your company is VAT registered)

- The total amount owed

Record-Keeping and Recording the Services You’re Charging For

Keeping a detailed and accurate record of the work completed for the customer, with a breakdown of each charge, can be very beneficial when it comes to invoicing. Making a note of all products sent or services completed, as they are finished, will save you time when sending an invoice to the customer, ensuring that nothing is forgotten and the customer is clear on the service that has been provided and when it was provided.

When working with a new client, be sure to ask for the contact details, including the phone number or email address of the person or department responsible for invoicing, so you have a point of contact once the invoice has been sent, should you need it in regard to late payment.

For best practice, be sure to include a unique invoice number, your bank account details or payment details, and your payment terms on the invoice to ensure fast payment. It is also a good idea to ensure you have a business bank account so the business name and details on the invoice match those shown on the payment method on the invoice.

Limited Company Invoice Template

A professional invoice template design that includes your company logo, ready to use whenever you need to send an invoice, will save you time and help you project a professional image to your clients.

You can create a basic invoice template, or if you use a modern accounting software product such as Xero, you can use their template, which has already been set up for you. You can also customise your template on a Microsoft Word document and upload it to Xero.

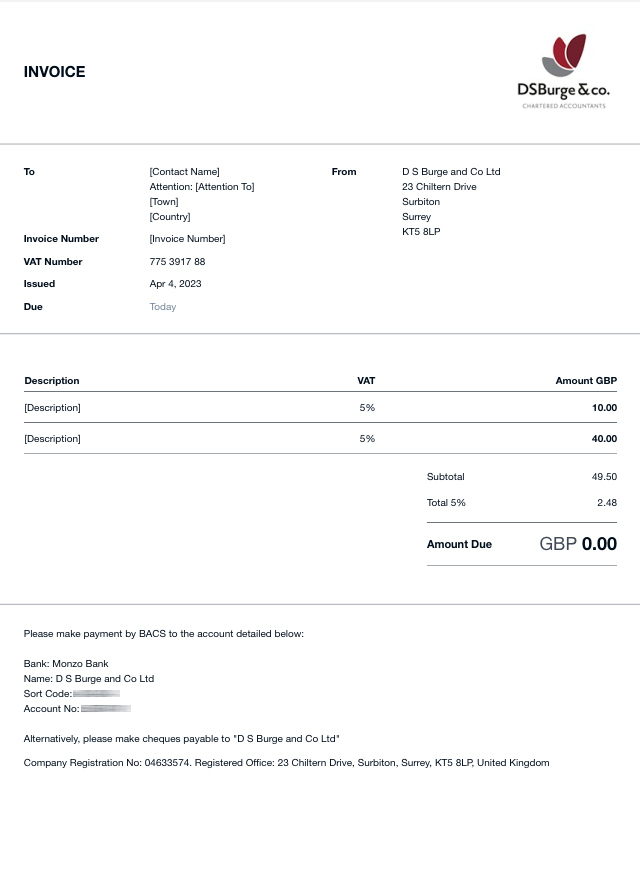

If you use Xero for your invoice template, here is an example of how it will look:

At DS Burge & Co, we can offer business tax advice and help you set up your invoice template. Please get in contact with us to find out more about our invoice services.